The biggest regulatory shakeup since the global financial crisis is hitting UK financial services firms this year, and that means a huge amount of operational, compliance, and legal work to manage. International law firm Addleshaw Goddard has developed a solution using BRYTER for their financial services clients that helps them more effectively manage this regulatory overhaul.

Sweeping regulatory changes for financial services

The clock is ticking. In less than 12 months, by July 31, 2023, UK financial services (FS) firms that serve UK retail customers must comply with the new Consumer Duty Regulations. The UK Financial Conduct Authority (FCA) has reset expectations around consumer protection and these sweeping changes represent “a significant shift in culture and behaviour by many firms.”

What does this actually mean? Simply put, it’s a massive compliance challenge. FS firms need to assess the thousands of financial products they offer to retail customers – everything from credit cards to mortgages – to ensure they comply with the new regulations. In broad strokes, this means two main things: First, FS firms need to ensure that consumers receive a good service and are not being sold something inappropriate. Second, FS firms need to ensure that the products they sell do not expose their institution to risk.

Why complying with the new regulations presents a challenge

Complying with the FCA’s new regulations is no simple task. One of the biggest challenges is that there is a lot of room for interpretation: It’s about “good governance” and adhering to “the spirit of the regulation.” But what is good governance? It all comes down to having the right processes and documentation — and this is where the bulk of the work begins.

In order to comply, the first thing FS firms need to do is to understand what they are offering retail clients, and how this stacks up against the new requirements. This involves collecting information from across multiple teams at the firm and storing this information in a way that can be used to make a clear assessment against the new regulations – no easy feat, especially considering the size of some FS firms.

Traditionally, FS firms would tackle a compliance challenge like this in one of the following ways.

Option 1: Increase legal and compliance headcount

FS firms have legal and compliance teams, but their capacity will already be allocated to pre-existing projects and “business-as-usual” work. The new Consumer Duty Regulations present a large and distinct project, which will require its own resourcing. However, as the global financial crisis showed, it is not easy to find additional headcount quickly enough to staff a large and complex project such as this.

Option 2: Outsource

Another option is to outsource this work, whether to a larger consultancy or a specialist in compliance. Firms could also hire temporary outsourced workers to fill the gap needed internally. This would amount to significant cost, delayed starting whilst processes are ironed out and would be a multi-year project that still puts strain on the usual compliance function within the firm. It would also still pose the problem of making a decision, outsourcing this would give FS firms their data, but it would still have to be assessed by the internal teams.

Neither of these options are ideal, either due to feasibility or cost.

Enter Addleshaw Goddard with a digital solution to meet this challenge

Addleshaw Goddard is a law firm that understands the totality of their clients’ challenges and seeks to provide end-to-end legal and compliance solutions. While traditionally a law firm may only become involved in a project like this after the initial review of information has been completed, Addleshaw Goddard knows that the real challenge their FS clients face is a practical one: how to collect information across the entire firm and assess their business against the FCA’s requirements.

“Providing a good client service means truly understanding your clients’ challenges and helping to solve them. For many of our clients, their challenges are not purely legal, but a mixture of legal, compliance, and operations,” explains Mandie Hulme, Partner, Head of Financial Regulation at Addleshaw Goddard.

“With the new Consumer Duty Regs, we understood a huge, practical challenge our clients faced: how to collect the information they need from across the firm to understand what gaps might exist, and where they might need additional support. Up until now, there were few options available to solve this: large and expensive consulting projects or unrealistic new headcount. We’re delighted to be in a position to offer our clients an alternative option with our UK Consumer Duty Regulations Digital Offering.”

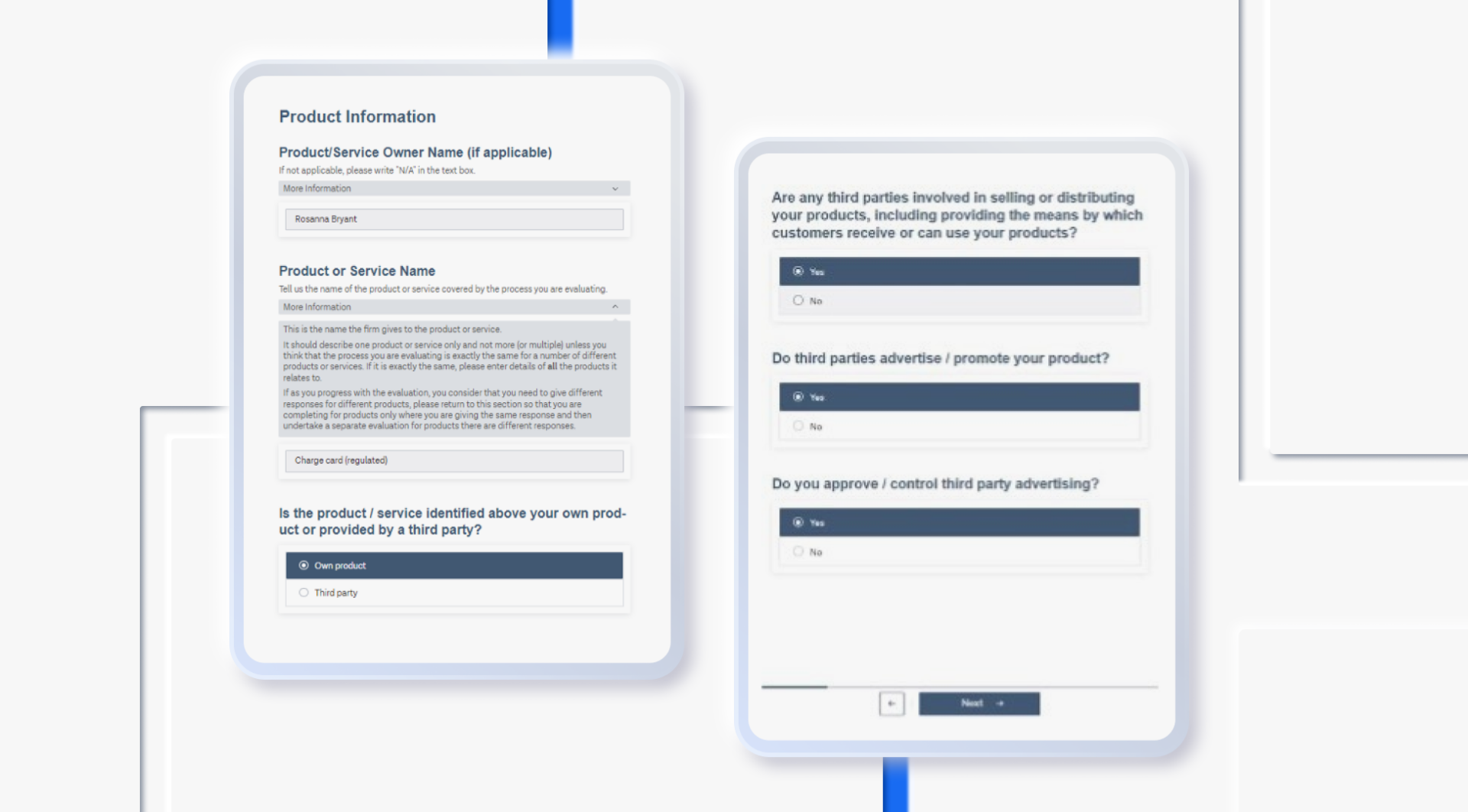

So how does the Addleshaw Goddard Consumer Duty Evaluator work?

“Our digital solution takes the entire Consumer Duty Regulations and basically streamlines them. Our Financial Regulation team digested the FCA’s regulations and broke them down into a questionnaire specifically designed for our financial institution clients affected by the changes. No superfluous questions are asked and by combining risk scoring, based on the answers, FS firms are given, an automatically generated, tailored report, which offers product and process specific gap analysis. It sets out what their current state is, and what they need to do to comply with the new regulations” explains James Whitaker, Senior Manager Innovation & Legal Technology.

Using BRYTER to digitize a complex compliance challenge

Digitizing a compliance challenge like the UK Consumer Duty Regs is only possible by using a platform like BRYTER.

“When our Fin Reg team first came to us, they had created a spreadsheet containing a detailed analysis of the Regulations which ran to hundreds of questions. Each question has its own risk score, and the response to each one has dependencies on other questions. It was the result of trying to distill such complex regulation into a simple process, but this Excel was not something we could use with clients. To create a digital solution to such a complex challenge like this, we needed a sophisticated and powerful tool, and BRYTER was the obvious choice. Our software needed to intake information, apply risk scoring, create dependencies based on pre-defined logic, have effective handovers, and be user-friendly enough to actually be used by the end users at our client organizations,” explains Emma Pitcher, Senior Legal Technologist.

“Consumer Duty Evaluator, as the tool is known, is a perfect use case for BRYTER automation: It is a complex compliance challenge, but one that can be mapped out. And frankly, to do it any other way would require a significant undertaking. It would involve asking hundreds of questions about hundreds of financial products and having to coordinate with tens of different departments across a firm. We were able to completely simplify this into one digital product offering to our clients,” said Mandie Hulme.

Scaling legal services with a digital product offering

Innovative teams at Addleshaw Goddard supplement traditional, hourly-based legal services with digital legal products, and see a number of benefits from doing so. James Whitaker explains the four core benefits of digital product offering.

1. Service more of our clients’ needs

“Traditionally, when facing a change of regulations such as these, our team would have done an advice note and billed clients for this. This is a static piece of information and would highlight what FS firms would need to do to be compliant.

A solution like the one we built with BRYTER goes beyond telling clients what they need to do: it gives them a practical solution that is tailored to their circumstances, and it means we are able to help our clients much earlier in the process,”.

2. Supplement traditional legal services

“We are in the business of providing legal services to our clients, and often the work we do is on the more complex and bespoke end of the spectrum. This is where the value in hourly-based billing comes for the firm, and for our clients. However, when we create digital products, we are able to supplement our hourly billing model and provide additional value to our clients.

Take this example: traditionally as a firm, we would have got involved much later on in the process — after, for example, another company would have done initial consulting to help the banking client work out their current state. Now, FS clients can use our digital products instead. This helps our clients, and it helps the firm because embedding a solution like this will help the client identify areas where they need bespoke hourly legal services, for example, updating their terms and conditions.”

3. Deepen client relationships and embed the firm in their clients’ processes

“Addleshaw Goddard’s digital legal products, are embedded in our clients’ processes. This helps deepen the client relationship, and ultimately means that instead of just a handful of people in the client’s legal or compliance team interacting with our firm, we now have hundreds of key stakeholders across our client organizations using our digital legal products and interacting with our legal expertise digitally on a daily basis.”

4. Scale services and win more projects

“One of the biggest benefits of building and selling digital legal products is scalability. The revenue we can generate as a firm is no longer limited by the number of fee-earners we have. Whereas before we might have been limited to only doing two new big client projects based on the number of fee-earners available, now we can win (for example) 100 new projects, do 100 new projects, and get paid for 100 new client projects, all with the same number of fee-earners. The possibility of exponential, non-linear revenue growth is only because we have been able to scale our legal services with digital products built on BRYTER.”

New challenges demand new solutions

The regulatory landscape in the UK — and across the world — is evolving more quickly than ever before. The new FCA regulations are just one example of many instances where firms need to quickly analyze, interpret, and act on a regulatory change, all while still delivering on day-to-day business priorities. Yesterday’s solutions will not meet today’s and tomorrow’s challenges.

More shakeups will come, and savvy law firms will embrace the increasing velocity of change as an opportunity to evolve their services, expand their offering, and tackle their clients’ challenges proactively.

About Addleshaw Goddard

Finding the smartest way to deliver the biggest impact.

The problems our clients bring us vary. But we solve them with the same, single-minded focus. We always ask: ‘What’s the smartest route to the biggest impact?’ For example:

- We led the legal negotiations for VW and Ford on one of the largest strategic alliances in the world, helping to forge a new era in electric and commercial vehicles across 170 markets. Impact: $billions of new value created.

- We helped devise a new way for our manufacturing client to power its new factory. Impact: a plan 90% cheaper than the next best option that saved them £100 million.

- We combined legal expertise and A.I. to complete a lease review of a retailer’s 189-site property portfolio. Impact: we slashed the time taken by 70% and costs by 75%.

- We interrogated data in blockchain to resolve a cyber-currency dispute. Impact: millions of bitcoin recovered for a tech start-up.

Each year, over 3,000 leading companies and finance players around the world trust us to deliver. We help them in multiple industries and in over 90 countries. Not just once, but again and again. Many of our 47 FTSE100 clients have been with us for more than 20 years: one for 150. Tomorrow’s problems won’t be solved with yesterday’s answers. And, we believe that good business demands good legal advice. Which, ultimately, comes down to just four words. Yes. No. Stop. Go. Assuming you’d value that clarity, imagination, and impact, we’d be delighted to talk business. Your business.